Texts belong to their owners and are placed on a site for acquaintance.

Country Differences in Accounting Standards

Accounting is shaped by the environment in which it operates. Just as different countries have different political systems, economic systems, and cultures, they also have different accounting systems.2 In each country, the accounting system has evolved in response to the demands for accounting information.

An example of differences in accounting conventions concerns employee disclosures. In many European countries, government regulations require firms to publish detailed information about their training and employment policies, but there is no such requirement in the United States. Another difference is in the treatment of goodwill. A firm's goodwill is any advantage, such as a trademark or brand name (e.g., the Coca-Cola brand name), that enables a firm to earn higher profits than its competitors. When one company acquires another in a takeover, the value of the goodwill is calculated as the amount paid for a firm above its book value, which is often substantial. Under accounting rules prevailing in many countries, acquiring firms are allowed to deduct the value of goodwill from the amount of equity or net worth reported on their balance sheet. In the United States, goodwill has to be deducted from the profits of the acquiring firm over as much as 40 years (although firms typically write down goodwill much more rapidly). If two equally profitable firms, one German and one American, acquire comparable firms that have identical goodwill, the US firm will report a much lower profit than the German firm, because of differences in accounting conventions regarding goodwill.3

Despite attempts to harmonize standards by developing internationally acceptable accounting conventions (more on this later), a myriad of differences between national accounting systems still remain. A study tried to quantify the extent of these differences by comparing various accounting measures and profitability ratios across 22 developed nations, including Australia, Britain, France, Germany, Hong Kong, Japan, Spain, and South Korea.4 The study found that among the 22 countries, there were 76 differences in the way cost of goods sold was assessed, 65 differences in the assessment of return on assets, 54 differences in the measurement of research and development expenses as a percentage of sales, and 20 differences in the calculation of net profit margin. These differences make it very difficult to compare the financial performance of firms based in different nation-states.

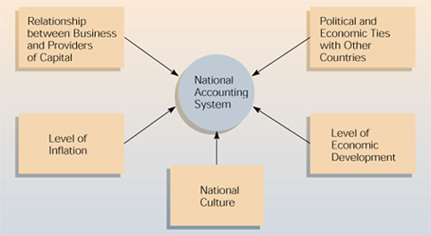

Although many factors can influence the development of a country's accounting system, there appear to be five main variables:5

1. The relationship between business and the providers of capital.

2. Political and economic ties with other countries.

3. The level of inflation.

4. The level of a country's economic development.

5. The prevailing culture in a country.

Figure 19.2 illustrates these variables. We will review each in turn.

Relationship between Business and Providers of Capital

The three main external sources of capital for business enterprises are individual investors, banks, and government. In most advanced countries, all three sources are important. In the United States, for example, business firms can raise capital by selling shares and bonds to individual investors through the stock market and the bond market. They can also borrow capital from banks and, in rather limited cases (particularly to support investments in defense-related R&D), from the government. The

Figure 19.2

Determinants of National Accounting Standards

importance of each source of capital varies from country to country. In some countries, such as the United States, individual investors are the major source of capital; in others, banks play a greater role; in still others, the government is the major provider of capital. A country's accounting system tends to reflect the relative importance of these three constituencies as providers of capital.

Consider the case of the United States and Great Britain. Both have well-developed stock and bond markets in which firms can raise capital by selling stocks and bonds to individual investors. Most individual investors purchase only a very small proportion of a firm's total outstanding stocks or bonds. As such, they have no desire to be involved in the day-to-day management of the firms in which they invest; they leave that task to professional managers. But because of their lack of contact with the management of the firms in which they invest, individual investors may not have the information required to assess how well the companies are performing. Because of their small stake in firms, individual investors generally lack the ability to get information on demand from management. The financial accounting system in both Great Britain and the United States evolved to cope with this problem. In both countries, the financial accounting system is oriented toward providing individual investors with the information they need to make decisions about purchasing or selling corporate stocks and bonds.

In countries such as Switzerland, Germany, and Japan, a few large banks satisfy most of the capital needs of business enterprises. Individual investors play a relatively minor role. In these countries, the role of the banks is so important that a bank's officers often have seats on the boards of firms to which it lends capital. In such circumstances, the information needs of the capital providers are satisfied in a relatively straightforward way--through personal contacts, direct visits, and information provided at board meetings. Consequently, although firms still prepare financial reports, because government regulations in these countries mandate some public disclosure of a firm's financial position, the reports tend to contain less information than those of British or US firms. Because banks are the major providers of capital, financial accounting practices are oriented toward protecting a bank's investment. Thus, assets are valued conservatively and liabilities are overvalued (in contrast to US practice) to provide a cushion for the bank in the event of default.

In still other countries, the national government has historically been an important provider of capital, and this has influenced accounting practices. This is the case in France and Sweden, where the national government has often stepped in to make loans or to invest in firms whose activities are deemed in the "national interest." In these countries, financial accounting practices tend to be oriented toward the needs of government planners.

Political and Economic Ties with Other Countries

Similarities in the accounting systems of countries are sometimes due to the countries' close political and/or economic ties. For example, the US system has influenced accounting practices in Canada and Mexico, and since passage of NAFTA, the accounting systems in these three countries seem set to converge on a common set of norms. US-style accounting systems are also used in the Philippines, which was once a US protectorate. Another significant force in accounting worldwide has been the British system. The vast majority of former colonies of the British empire have accounting practices modeled after Great Britain's. Similarly, the European Union has been attempting to harmonize accounting practices in its member countries. The accounting systems of EU members such as Great Britain, Germany, and France are quite different now, but they may all converge on some norm eventually.

Inflation Accounting

In many countries, including Germany, Japan, and the United States, accounting is based on the historic cost principle. This principle assumes the currency unit used to report financial results is not losing its value due to inflation. Firms record sales, purchases, and the like at the original transaction price and make no adjustments in the amounts later. The historic cost principle affects accounting most significantly in the area of asset valuation. If inflation is high, the historic cost principle underestimates a firm's assets, so the depreciation charges based on these underestimates can be inadequate for replacing assets when they wear out or become obsolete.

The appropriateness of this principle varies inversely with the level of inflation in a country. The high level of price inflation in many industrialized countries during the 1970s created a need for accounting methods that adjust for inflation. A number of industrialized countries adopted new practices. One of the most far-reaching approaches was adopted in Great Britain in 1980. Called current cost accounting, it adjusts all items in a financial statement--assets, liabilities, costs, and revenues--to factor out the effects of inflation. The method uses a general price index to convert historic figures into current values. The standard was not made compulsory, however, and once Great Britain's inflation rate fell in the 1980s, most firms stopped providing the data.

Level of Development

Developed nations tend to have large, complex organizations, whose accounting problems are far more difficult than those of small organizations. Developed nations also tend to have sophisticated capital markets in which business organizations raise funds from investors and banks. These providers of capital require that the organizations they invest in and lend to provide comprehensive reports of their financial activities. The work forces of developed nations tend to be highly educated and skilled and can perform complex accounting functions. For all these reasons, accounting in developed countries tends to be far more sophisticated than it is in less developed countries, where the accounting standards may be fairly primitive.

Culture

A number of academic accountants have argued that the culture of a country has an important impact upon the nature of its accounting system.6 Using the cultural typologies developed by Hofstede,7 which we reviewed in Chapter 3, researchers have found that the extent to which a culture is characterized by uncertainty avoidance seems to have an impact on accounting systems.8 Uncertainty avoidance refers to the extent to which cultures socialize their members to accept ambiguous situations and tolerate uncertainty. Members of high uncertainty avoidance cultures place a premium on job security, career patterns, retirement benefits, and so on. They also have a strong need for rules and regulations; the manager is expected to issue clear instructions, and subordinates' initiatives are tightly controlled. Lower uncertainty avoidance cultures are characterized by a greater readiness to take risks and less emotional resistance to change. According to Hofstede, countries such as Britain, the United States and Sweden are characterized by low uncertainty avoidance, while countries such as Japan, Mexico, and Greece have higher uncertainty avoidance. Research suggests that countries with low uncertainty avoidance cultures tend to have strong independent auditing professions that audit a firm's accounts to make sure they comply with generally accepted accounting regulations.9

Accounting Clusters

Few countries have identical accounting systems. Notable similarities between nations do exist, however, and three groups of countries with similar standards are identified in Map 19.1.10 One group might be called the British-American-Dutch group. Great Britain, the United States, and the Netherlands are the trendsetters in this group. All these countries have large, well-developed stock and bond markets where firms raise capital from investors. Thus, their accounting systems are tailored to providing information to individual investors. A second group might be called the Europe-Japan group. Firms in these countries have very close ties to banks, which supply a large proportion of their capital needs. Therefore, their accounting practices are geared to the needs of banks. A third group might be the South American group. The countries in this group have all experienced persistent and rapid inflation. Consequently, they have adopted inflation accounting principles.