Texts belong to their owners and are placed on a site for acquaintance.

Introduction

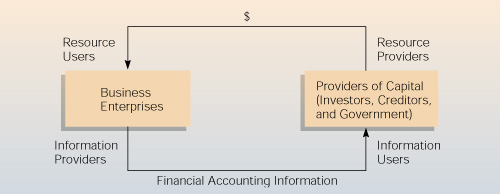

Accounting has often been referred to as "the language of business."1 This language finds expression in profit-and-loss statements, balance sheets, budgets, investment analysis, and tax analysis. Accounting information is the means by which firms communicate their financial position to the providers of capital investors, creditors, and government. It enables the providers of capital to assess the value of their investments or the security of their loans and to make decisions about future resource allocations (see Figure 19.1). Accounting information is also the means by which firms report their income to the government, so the government can assess how much tax the firm owes. It is also the means by which the firm can evaluate its performance, control its internal expenditures, and plan for future expenditures and income. Thus, a good accounting function is critical to the smooth running of the firm.

International businesses are confronted with a number of accounting problems that do not confront purely domestic businesses. The opening case draws attention to one of these problems--the lack of consistency in the accounting standards of different countries. We begin this chapter by looking at the source of these country differences. Then we shift our attention to attempts to establish international accounting and auditing standards--the International Accounting Standards Committee (IASC).

We will examine the problems arising when an international business with operations in more than one country must produce consolidated financial statements. As we will see, these firms face special problems because, for example, the accounts for their operations in Brazil will be in real, in Korea they will be in won, and in Japan they will be in yen. If the firm is based in the United States, it will have to decide what basis to use for translating all these accounts into US dollars. The last issue we discuss is control in an international business. We touched on the issue of control in Chapter 13 in rather abstract terms. Here we look at control from an accounting perspective.

Figure 19.1

Accounting Information and Capital Flows