Texts belong to their owners and are placed on a site for acquaintance.

Accounting Aspects of Control Systems

Corporate headquarters' role is to control subunits within the organization to ensure they achieve the best possible performance. In the typical firm, the control process is annual and involves three main steps:

- Head office and subunit management jointly determine

subunit goals for the coming year.

- Throughout the year, the head office monitors subunit

performance against the agreed goals.

- If a subunit fails to achieve its goals, the head office intervenes in the subunit to learn why the shortfall occurred, taking corrective action when appropriate.

The accounting function plays a critical role in this process. Most of the goals for subunits are expressed in financial terms and are embodied in the subunit's budget for the coming year. The budget is the main instrument of financial control. The budget is typically prepared by the subunit, but it must be approved by headquarters management. During the approval process, headquarters and subunit managements debate the goals that should be incorporated in the budget. One function of headquarters management is to ensure a subunit's budget contains challenging but realistic performance goals. Once a budget is agreed to, accounting information systems are used to collect data throughout the year so a subunit's performance can be evaluated against the goals contained in its budget.

In most international businesses, many of the firm's subunits are foreign subsidiaries. The performance goals for the coming year are thus set by negotiation between corporate management and the managers of foreign subsidiaries. According to one survey of control practices within multinational enterprises, the most important criterion for evaluating the performance of a foreign subsidiary is the subsidiary's

Table 19.1

Importance of Financial Criteria Used to Evaluate Performance of Foreign Subsidiaries and Their Managers*

| Item | Subsidiary | Manager |

| Return on investment (ROI) | 1.9 | 2.2 |

| Return on equity (ROE) | 3.0 | 3.0 |

| Return on assets (ROA) | 2.3 | 2.3 |

| Return on sales (ROS) | 2.1 | 2.1 |

| Residual income | 3.4 | 3.3 |

| Budget compared to actual sales | 1.9 | 1.7 |

| Budget compared to actual profit | 1.5 | 1.3 |

| Budget compared to actual ROI | 2.3 | 2.4 |

| Budget compared to actual ROA | 2.7 | 2.5 |

| Budget compared to actual ROE | 3.1 | 3.0 |

*Importance of criteria ranked on a scale from: 1 = very important to 5 = unimportant.

Source: F. Choi and I. Czechowicz, "Assessing Foreign Subsidiary Performance: A Multinational Comparison," Management International Review 4 (1983), p. 16.

actual profits compared to budgeted profits (see Table 19.1).14 This is closely followed by a subsidiary's actual sales compared to budgeted sales and its return on investment. The same criteria were also useful in evaluating the performance of the subsidiary managers (see Table 19.1). We will discuss this point later in this section. First, however, we will examine two factors that can complicate the control process in an international business: exchange rate changes and transfer pricing practices.

Exchange Rate Changes and Control Systems

Most international businesses require all budgets and performance data within the firm to be expressed in the "corporate currency," which is normally the home currency. Thus, the Malaysian subsidiary of a US multinational would probably submit a budget prepared in US dollars, rather than Malaysian ringgit, and performance data throughout the year would be reported to headquarters in US dollars. This facilitates comparisons between subsidiaries in different countries, and it makes things easier for headquarters management. However, it also allows exchange rate changes during the year to introduce substantial distortions. For example, the Malaysian subsidiary may fail to achieve profit goals not because of any performance problems, but merely because of a decline in the value of the ringgit against the dollar. The opposite can occur, also, making a foreign subsidiary's performance look better than it actually is.

The Lessard - Lorange Model

According to research by Donald Lessard and Peter Lorange, a number of methods are available to international businesses for dealing with this problem.15 Lessard and Lorange point out three exchange rates that can be used to translate foreign currencies into the corporate currency in setting budgets and in the subsequent tracking of performance:

- The initial rate,

the spot exchange rate when the budget is adopted.

- The projected rate,

the spot exchange rate forecast for the end of the budget period (i.e.,

the forward rate).

- The ending rate, the spot exchange rate when the budget and performance are being compared.

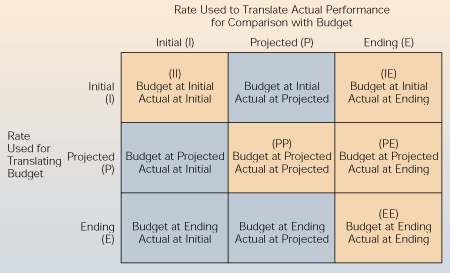

These three exchange rates imply nine possible combinations

(see Figure 19.3). Lessard and Lorange ruled out four of the nine combinations

as illogical and unreasonable; they are shaded in Figure 19.3. For example,

it would make no sense to use

Figure 19.3

Possible Combinations of Exchange Rates in the Control

Process

the ending rate to translate the budget and the initial rate to translate actual performance data. Any of the remaining five combinations might be used for setting budgets and evaluating performance.

With three of these five combinations-II, PP, and EE-the same exchange rate is used for translating both budget figures and performance figures into the corporate currency. All three combinations have the advantage that a change in the exchange rate during the year does not distort the control process. This is not true for the other two combinations, IE and PE. In those cases, exchange rate changes can introduce distortions. The potential for distortion is greater with IE; the ending spot exchange rate used to evaluate performance against the budget may be quite different from the initial spot exchange rate used to translate the budget. The distortion is less serious in the case of PE because the projected exchange rate takes into account future exchange rate movements.

Of the five combinations, Lessard and Lorange recommend that firms use the projected spot exchange rate to translate both the budget and performance figures into the corporate currency, combination PP. The projected rate in such cases will typically be the forward exchange rate as determined by the foreign exchange market (see Chapter 9 for the definition of forward rate) or some company-generated forecast of future spot rates, which Lessard and Lorange refer to as the internal forward rate. The internal forward rate may differ from the forward rate quoted by the foreign exchange market if the firm wishes to bias its business in favor of, or against, the particular foreign currency.

Transfer Pricing and Control Systems

In Chapter 12 we reviewed the various strategies that international businesses pursue. Two of these strategies, the global strategy and the transnational strategy, give rise to a globally dispersed web of productive activities. Firms pursuing these strategies disperse each value creation activity to its optimal location in the world. Thus, a product might be designed in one country, some of its components manufactured in a second country, other components manufactured in a third country, all assembled in a fourth country, and then sold worldwide.

The volume of intrafirm transactions in such firms is very high. The firms are continually shipping component parts and finished goods between subsidiaries in different countries. This poses a very important question: How should goods and services transferred between subsidiary companies in a multinational firm be priced? The price at which such goods and services are transferred is referred to as the transfer price.

The choice of transfer price can critically affect the performance of two subsidiaries that exchange goods or services. Consider this example: A French manufacturing subsidiary of a US multinational imports a major component from Brazil. It incorporates this part into a product that it sells in France for the equivalent of $230 per unit. The product costs $200 to manufacture, of which $100 goes to the Brazilian subsidiary to pay for the component part. The remaining $100 covers costs incurred in France. Thus, the French subsidiary earns $30 profit per unit.

| Before Change | After 20 Percent | |

| in Transfer | Increase in | |

| Price | Transfer Price | |

| Revenues per unit | $230 | $230 |

| Cost of component per unit | 100 | 120 |

| Other costs per unit | 100 | 100 |

| Profit per unit | $30 | $10 |

Look at what happens if corporate headquarters decides to increase transfer prices by 20 percent ($20 per unit). The French subsidiary's profits will fall by two-thirds from $30 per unit to $10 per unit. Thus, the performance of the French subsidiary depends on the transfer price for the component part imported from Brazil, and the transfer price is controlled by corporate headquarters. When setting budgets and reviewing a subsidiary's performance, corporate headquarters must keep in mind the distorting effect of transfer prices.

How should transfer prices be determined? We discuss this issue in detail in the next chapter. International businesses often manipulate transfer prices to minimize their worldwide tax liability, minimize import duties, and avoid government restrictions on capital flows. For now, however, it is enough to note that the transfer price must be considered when setting budgets and evaluating a subsidiary's performance.

Separation of Subsidiary and Manager Performance

Table 19.1 suggests that in many international businesses, the same quantitative criteria are used to assess the performance of both a foreign subsidiary and its managers. Many accountants, however, argue that although it is legitimate to compare subsidiaries against each other on the basis of return on investment (ROI) or other indicators of profitability, it may not be appropriate to use these for comparing and evaluating the managers of different subsidiaries. Foreign subsidiaries do not operate in uniform environments; their environments have widely different economic, political, and social conditions, all of which influence the costs of doing business in a country and hence the subsidiaries' profitability. Thus, the manager of a subsidiary in an adverse environment that has an ROI of 5 percent may be doing a better job than the manager of a subsidiary in a benign environment that has an ROI of 20 percent. Although the firm might want to pull out of a country where its ROI is only 5 percent, it may also want to recognize the manager's achievement.

Accordingly, it has been suggested that the evaluation of a subsidiary should be kept separate from the evaluation of its manager.16 The manager's evaluation should consider how hostile or benign the country's environment is for that business. Further, managers should be evaluated in local currency terms after making allowances for those items over which they have no control (e.g., interest rates, tax rates, inflation rates, transfer prices, exchange rates).